Til’ Debt

Do Us Part

Britain’s Concealed Cash Revealed

Have you ever hidden debt from your partner or kept a salary hike on the hush? Well, you're not alone.

Here at Claim Your Mortgage we believe financial infidelity and hidden debts could be impacting the UK’s ability to save for a house or move up the property ladder, so we surveyed 2,018 people in relationships up and down the country to find out who dodges debt discussions the most and where in the country is concealing the most cash.

What is Financial Infidelity?

According to Wikipedia…

The secretive act of spending money, possessing credit and credit cards, holding secret accounts or stashes of money, borrowing money or otherwise incurring debt unknown or unwilling to one’s spouse, partner, or significant other.

Britain’s hidden bank statements revealed

Trust and responsibility are two of the most desirable attributes in a parter, but our research suggests many of us have made a habit of telling financial fibs. Whether you keep separate bank accounts, have shared financial responsibilities or are storing away sums of money for a rainy day, withholding wealth is more common than you might think.

One in three people have hidden debts from their partner

The average UK hidden debt is £3,600

Women are more likely to conceal bank statements than men

75% of married people don’t know how much debt their spouse is in

hiding large debts was ranked worse than not admitting to having a child

Who is concealing the most capital?

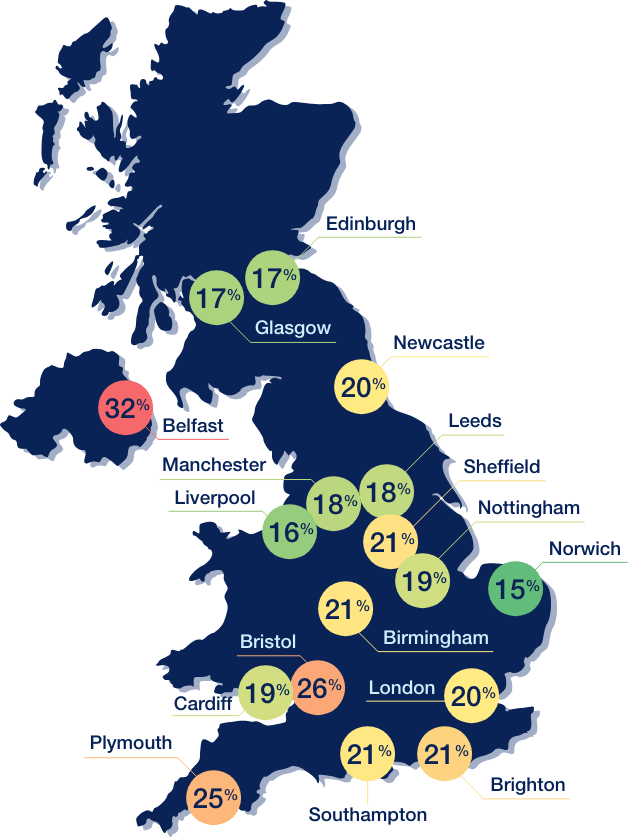

Secretive couples around the UK are hiding up to £5,000 in hidden credit card or personal loan debt from their partner and on a regional level, couples living in London, Liverpool and Belfast are the worst offenders, whilst the people of Nottingham have the lowest level of hidden debt at just £1,681.

How does your city compare?

Use our interactive map to see which UK cities are hiding their finances the most.

Show percentage of people who have hidden:

Hidden debts

We asked: If you’ve hidden debts from your partner, how much was it?

| London | £4,970.83 |

| Liverpool | £4,607.14 |

| Belfast | £4,330.00 |

| Southampton | £4,130.68 |

| Leeds | £4,081.08 |

| Norwich | £3,993.42 |

| Bristol | £3,774.73 |

| Glasgow | £3,373.56 |

| Birmingham | £3,329.02 |

| Edinburgh | £2,845.68 |

| Cardiff | £2,838.24 |

| Newcastle | £2,666.67 |

| Brighton | £2,594.83 |

| Manchester | £2,560.98 |

| Sheffield | £2,352.11 |

| Plymouth | £1,885.42 |

| Nottingham | £1,680.67 |

Does career success increase the likelihood of lying?

Analysing the results by employment status reveals those in senior manager and director positions are the most likely to hide debt, bonuses and pay rises and those higher up the professional food chain are the biggest repeat offenders.

Senior Managers or Directors have hidden credit card debt more than once

Senior Managers or Directors have hidden a bonus or pay rise more than once

Directors are most likely to hide a salary increase on multiple occasions